Well-positioned to navigate continued dynamic operating environment

Gradual, steady industry recovery expected throughout 2024

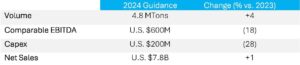

Monterrey, N.L., Mexico. February 21st, 2024 – Alpek, S.A.B. de C.V. (“Alpek” or “the Company”) announced today its 2024 guidance figures and key assumptions.

Alpek is strategically positioned to navigate the challenging macroeconomic conditions that defined the petrochemical industry in 2023 and that are expected to persist in the near term. The prevailing market oversupply is anticipated to keep reference margins at low levels for both Polyester and EPS. As we progress through the year, we foresee a gradual industry recovery. This, in turn, is expected to drive Polyester and EPS volume slightly higher. For PP, we anticipate a decline in volume and margins as the North American region continues to absorb new capacity that has recently come online.

Alpek’s Guidance figures are based on the following key assumptions:

- Integrated PET margins of U.S. $270 per ton for Asia and U.S. $170 per ton for China

- PP reference margin of U.S. $0.16 per pound

- Exclusion of Inventory Adjustment and carry-forward effect

- Average container ocean freight costs at normal levels

share this post

download as PDF

download as PDF