Strong business fundamentals expected to carry over into 2022

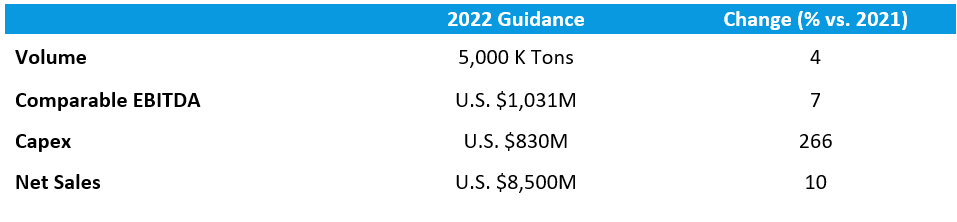

Monterrey, N.L., Mexico. February 16th, 2022 – Alpek, S.A.B. de C.V. (“Alpek” or “the Company”) announced today its 2022 Guidance figures and key assumptions.

The Company expects the strong business fundamentals behind its 2021 record performance to continue in 2022. In the Polyester segment, volume would rise as the adverse weather-related events of 2021 are avoided. Asian integrated PET margins should decline year-on-year, however a normalization in the North America – Asia spread, which was tighter in 2021, would result in a net positive effect on margins. In the Plastics & Chemicals segment, volume is also expected to remain at last year’s record levels. EPS reference margins are expected to remain steady, while Polypropylene reference margins should decline from 2021 record levels yet normalize above historical averages.

Alpek’s Guidance figures are based on the following key assumptions:

- Average Brent crude oil reference price of U.S. $81 per barrel

- Asian Integrated PET reference margins of U.S. $315 per ton

- OCTAL-related CAPEX of U.S. $620 million

- Exclusion of Inventory Adjustment, Carry-forward effect and OCTAL-related EBITDA

share this post

download as PDF

download as PDF